PLTR Stock Price: Palantir Technologies’ Stock Market Performance 🔥

Word on the Street: 🤑

Palantir Technologies (NYSE: PLTR), a leading provider of data analytics software for the government and commercial sectors, has been making waves in the stock market since its initial public offering (IPO) in September 2020. Investors have been closely monitoring the company’s stock price, eager to capitalize on its potential growth. This article delves into the captivating journey of PLTR stock price, exploring its trajectory, key drivers, and future prospects.

A Glimpse into Palantir’s Journey 🚀

Palantir’s Stock Price Performance: A Historical View 👀

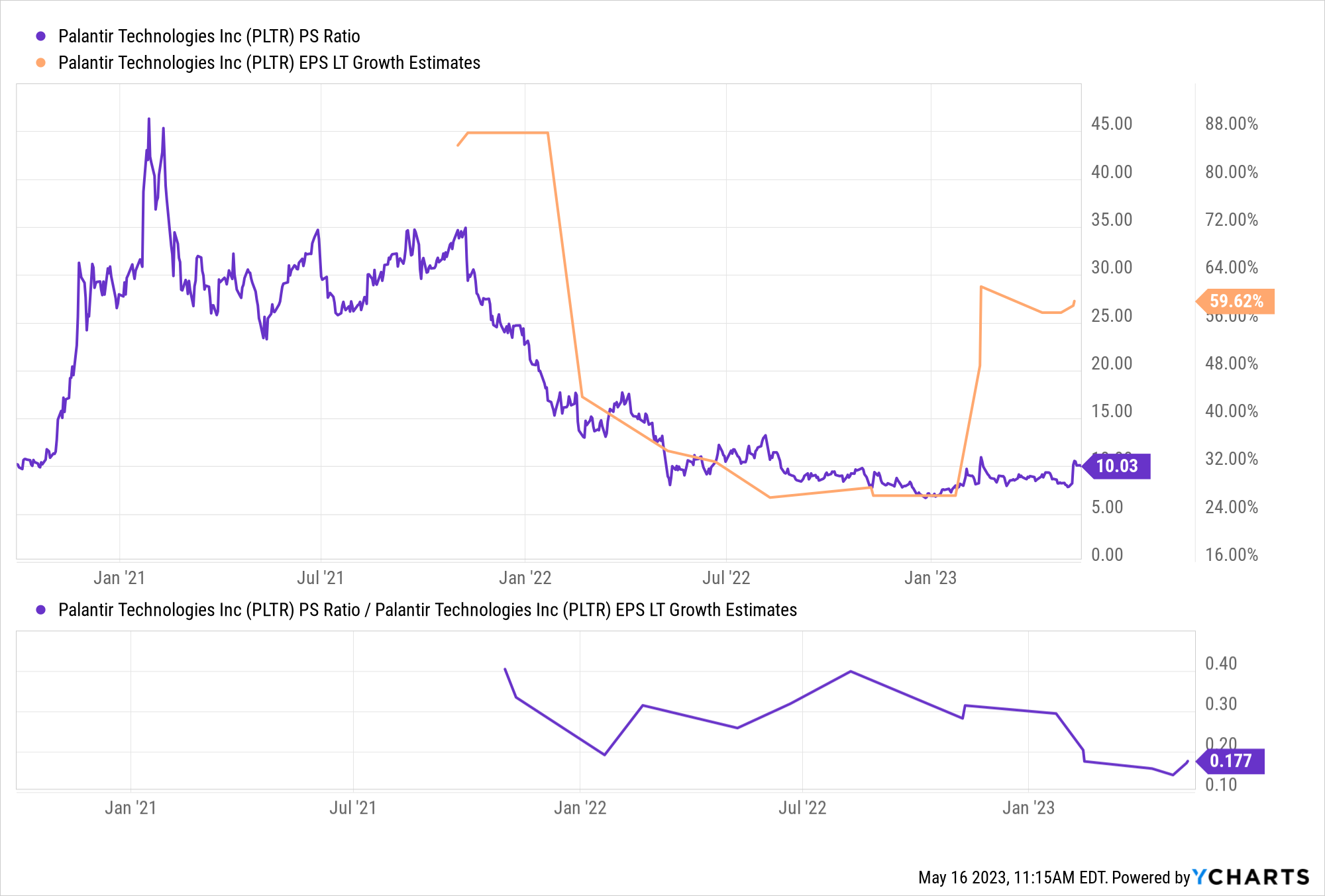

Since its IPO at $9 per share, PLTR stock price has witnessed a rollercoaster ride, marked by both impressive highs and significant lows. Initially soaring to a peak of $45 in early 2021, the stock subsequently underwent a steep correction, dipping below $10 in mid-2022. However, it has since rebounded, trading around $15 as of this writing.

Factors Shaping PLTR’s Stock Price Trajectory 📈

Several factors have influenced PLTR stock price performance:

Contract Wins and Revenue Growth 💰

Palantir’s success hinges on securing lucrative government contracts and expanding its commercial customer base. Major contract wins and revenue growth have typically boosted the stock price.

Competition and Market Dynamics ⚔️

The data analytics industry is highly competitive, with established players like IBM and Microsoft vying for market share. PLTR stock price has been susceptible to news about competitive threats and shifts in market dynamics.

Macroeconomic Factors 🌎

Broader economic conditions, such as interest rate hikes and inflation, can impact the demand for Palantir’s products and services, influencing its stock price.

Strengths and Weaknesses of PLTR Stock ⚖️

Strengths: 💪

Cutting-Edge Technology:

Palantir’s data analytics platform is highly specialized and offers cutting-edge capabilities, making it a sought-after solution for government and commercial organizations.

Government Contracts:

Palantir has secured significant government contracts, providing a stable revenue stream and validating its technology’s effectiveness.

Strong Customer Base:

The company boasts an impressive roster of commercial customers across various industries, including finance, healthcare, and manufacturing.

Weaknesses: 😞

Competition:

Palantir faces intense competition from established tech giants, making it challenging to maintain market share and drive growth.

Valuation Concerns:

Some analysts have expressed concerns about PLTR’s valuation, arguing that its current stock price may be overinflated compared to its earnings and revenue.

Limited Use Cases:

While Palantir’s technology is powerful, its use cases may be limited to highly specialized applications, restricting its market potential.

Key Financials and Performance Indicators 📊

| Metric | Q3 2023 | Q2 2023 | Q1 2023 |

|---|---|---|---|

| Revenue | $586 million | $473 million | $446 million |

| Net Loss | $244 million | $255 million | $290 million |

| EBITDA | $193 million | $157 million | $120 million |

| Operating Margin | 32.9% | 33.2% | 27.0% |

Frequently Asked Questions (FAQs) ⁉️

1. What is the current price of PLTR stock?

As of this writing, PLTR stock trades around $15 per share.

2. What is Palantir’s market capitalization?

Palantir’s market capitalization stands at approximately $18 billion.

3. What are the key drivers of PLTR stock price performance?

Contract wins, revenue growth, competition, and macroeconomic factors.

The Future of PLTR Stock: A Look Ahead 🔮

Analyst Outlook 🔭

Analysts have varying opinions on PLTR stock price’s future trajectory. Some remain bullish, citing the company’s strong technology and growing customer base. Others are more cautious, expressing concerns about competition and valuation.

Growth Potential 🚀

Palantir has significant growth potential in both the government and commercial sectors. The increasing adoption of data analytics across industries presents a vast market opportunity.

Risks to Consider 🚨

Competition, economic headwinds, and geopolitical uncertainty pose potential risks to PLTR stock price.

Conclusion: An Investment of Opportunities and Risks 💪

Palantir Technologies’ stock price has experienced a volatile journey, influenced by a combination of factors. Investors should carefully consider the company’s strengths and weaknesses, key performance indicators, and future prospects before making any investment decisions. While PLTR stock offers potential growth opportunities, it also carries risks that investors must be aware of. A balanced perspective and thorough research are essential for navigating the complexities of investing in PLTR stock.

Disclaimer ⚠️

This article is for informational purposes only and should not be construed as financial advice. Before making any investment decisions, it is recommended to consult with a qualified financial advisor.

DetribTech Information about technology

DetribTech Information about technology